Today I began with screening for companies having good return on capital, providing decent interest coverage ratio and paying out dividends.

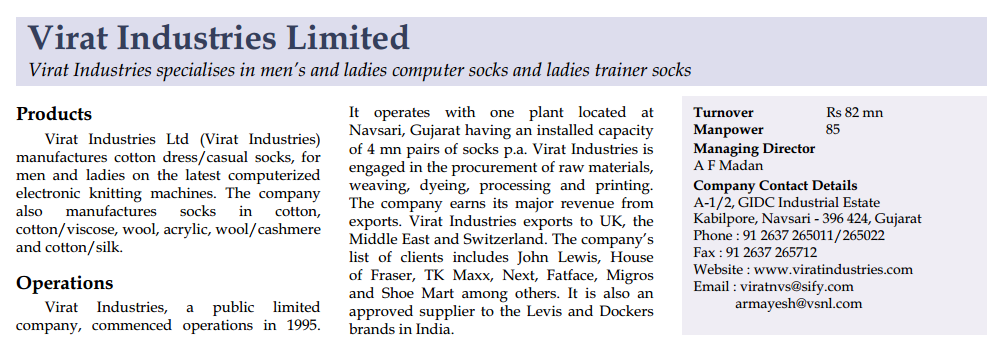

One of the interesting companies that came up was Virat Industries. I specifically liked the detailed annual reports and the business details the company provided 1 . On the fundamental side, the stock provides a good dividend yield of 6%. The company is debt-free, has 1.5 crores of cash (against a market capitalization of 11.76 crores), decent return ratios and a consistent performance record 2 .

At the PE of 4.5 and price near the book value, the stock surely looked very attractive (the promoters too have been buying small quantities). I went on to discuss the company with an expert.

I was asked to compare the company with Arex Industries and Premco Global. Arex has amazing operating cashflows (more than the company's market capitalization for each of the last 4 years).

The problem with these companies is not the operations or valuations, but the scale of opportunities. These business are too competitive in nature (due to a commodity product) and it is hard to scale their turnover beyond a size. In textile, this is further compounded due to competition from Bangladesh and China.

He explained that if we are going into small-caps, then we should look for superior returns. Look for businesses which have potential of growing at more than 20% year-on-year due to the advantage of their small size. Otherwise we are only aiming at average returns, which can be obtained from safer large-cap stocks too.

This surely clicked to me. Their might be some mis-pricing in these stocks, but that reminds me of the essay by Charlie Munger:

Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result.

So the trick is getting into better businesses.

Over last decade, Virat's stock has given modest 15% returns, and Arex stock has gone nowhere in the last 5 years, both inline with their businesses performances.

-

Jason Zweig wrote a wonderful essay on the good communication by the companies: The Tale of Two Washingtons ↩

-

2011 had an abnormally low OPM (of 5% against 23% the year before, but the same can be blamed to the abnormal rise in the cotton yarn prices: Cotton price chart ↩