Prof.Bakshi shared a very insightful presentation today. While his earlier article did discuss about the better returns in "great businesses", in this new article he explains why cigar-butt investing doesn't work and why even at a PE of 25 times, the valuations are still cheap.

Main takeaways

Two reasons why cigar-butts don't work

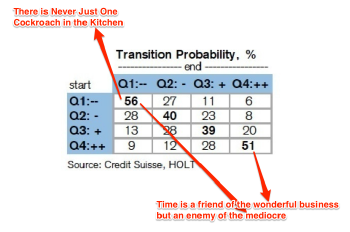

- In a difficult business, no sooner is one problem solved than another surfaces - never is there just one cockroach in the kitchen.

- Time is the friend of the wonderful business, the enemy of the mediocre. [i.e. in the low quality business the return on capital is very low. Thus for each passing by year where the value doesn't unlock, the rise in the intrinsic value is only marginal. While in the case of high quality businesses, as the return on capital is high, the intrinsic value nears the high paid price.]

The reasons why Graham & Dodd advocated on "buying cheap" was because of "powerful temporary effect upon all business through the variations of the economic cycle." Thus during a temporary shift in the economic cycle the growth suddenly disappears and the stocks are beaten down. This is "guarded against by unvarying insistence upon the reasonableness of the price paid for each purchase." [Pg.367 of Security Analysis]

The above is true for most of the businesses. In-fact the "great businesses" are GREAT because they rarely witness the "variations of the economic cycle" as they are largely recession-proof.

Calculating intrinsic value

intrinsic value - the figure indicating what all of our constituent businesses are rationally worth. With perfect foresight, this number can be calculated by taking all future cash flows of a business - in and out - and discounting them at prevailing interest rates.

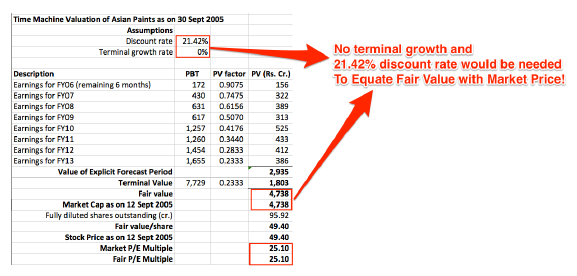

This was an interesting learning on how we can use the concept of DCF for reverse-engineering. By using the actual earnings of last few years we can know have the "perfect foresight" and market expectations on an historical date.

Another interesting part was about using the actual discount rates for future calculations.

Buffett does not add a risk premium. Instead, he relies on his single-minded focus on companies with consistent and predictable earnings and on the margin of safety that comes from buying at a substantial discount in the first place.

Graham & Dodd criticised DCF as it involved "assuming certain vital facts about future earnings, distribution policy and interest rates" [Pg.364 of the Security Analysis]

What are great businesses

Companies that have a established track record of delivering high owner earnings in relation to capital.

[...] Projects where profitability is high and overwhelmingly likely to succeed.

[...] Businesses that have enduring competitive advantages backed by demonstrated consistent earning power, and it so happens that those types of businesses happen to be concentrated in sectors having persistent CFROI's.

Graham & Dodd too appreciated the results of successful growth investing. But they maintained that "identification of growth company is not so simple a matter as it may appear. It cannot be accomplished solely by an examination of the statistics and records but requires a considerable supplement of special investigation and of business judgement... the real question is whether or not all careful and intelligent investors can follow this policy with fair success."

Graham and Dodd classified the companies as great companies which "participate in general record of growth so that they combine the advantages of a long period of upbuilding and an exceptional ability to expand later."

On the stock front, I wasn't able to study any new stocks but the ones that were mentioned in the presentation itself.