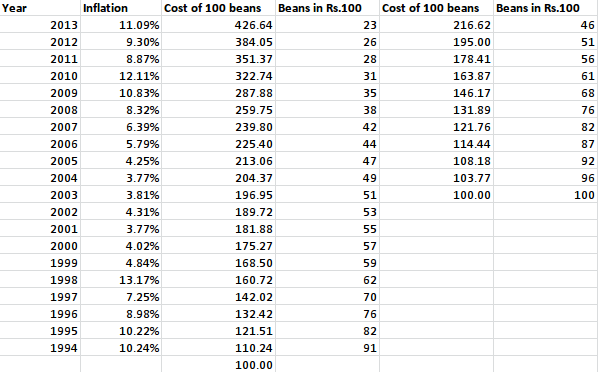

In the introductory chapters of "Common Stocks and Uncommon Profits", Philip Fisher looks at inflation in terms of money depreciation over a long period. I computed the parallel figures for Indian environment.

The average rate of inflation in India has been 8.07%. Thus in 10 years, the purchasing power depreciates by 54%, and in 20 years it depreciates by 77%.

The initial chapters also talked about why a good growth company must be investing in research and provided a few scuttlebutt techniques. Will try to find atleast one company which has been investing in research and try to apply the scuttlebutt techniques in the upcoming week.

In stocks, I had a look at Bharat Agri Fertilizers and Reality. The numbers look interesting, but the profits are mainly from the real-estate business. I couldn't find their website or much details about their projects. Thus left the analysis after a cursory glance.