Chapter 29 of Security Analysis talks about dividend payouts. After reading the chapter, I was set to find companies with more than 50% dividend payouts. One of the interesting names that came up was Kothari Petrochemicals.

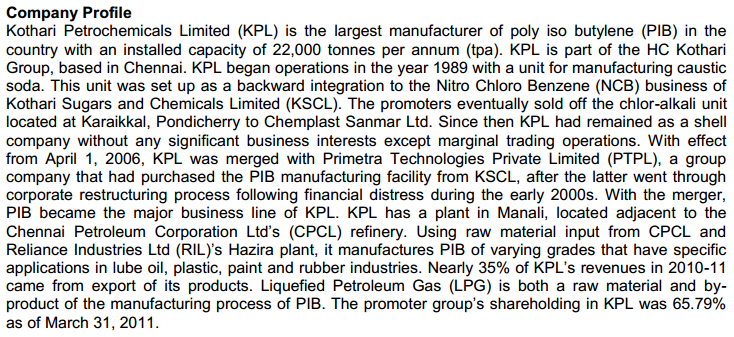

Company's brief from ICRA's report:

At the current market cap of ~50 crores, the company provides a dividend yield of 9%. Recent quarters have been much better than last year (net profit of 11 crores during trailing 12 months vs 5.21 crores during FY2013.) Thus if the company maintains the payout ratio of over 50%, then the resulting yield will be attractively over 10%.

On the business end, not much history is available. The margins in the business are very low (~5%), and the annual report isn't much optimistic either. The return on capital employed has staggered due to the increases in the fixed assets 1.

On the valuation front, the stock looks very interesting (primarily due to the seductive dividend yield). What the company ends up doing with the year's profits should determine the fate of the stock. If the company distributes the profits as dividends, it will improve the credibility and trust in the management. And if the company invests the profits in the un-required fixed assets (as it did in 2011-12), then the markets will probably label the management as crooked.

-

The company increased fixed assets by 27 crores in 2012. Around 14 crores was for a "building on lease" (which gets a rent of 1.23 crores) and 13 crores was for a windmill. The windmill was disposed off in 2013 for 9 crores. The net loss seems to be around 2 crores (after depreciation) charged to income and loss account in 2013. ↩