After a little gap, I resumed with Suven Life Sciences Ltd today.

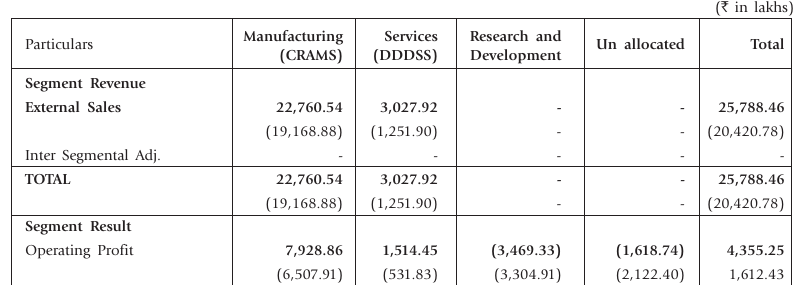

The company primarily has 3 main segments:

- CRAMS (Contract Research & Manufacturing): "brings in new technologies and cost savings in manufacturing"

- DDDSS (Drug Discovery & Development Support System): "brings in speed in preclinical development and clinical trials thus reducing time and money spent"

- Research & Development: "brings in innovation" in the field of Central Nervous System (CNS)

The company has had a consistent revenue growth of over 25% during the last few years. The profits too have shown a geometric growth during this period. 90% of the company's revenue is from exports, and primarily comes from CRAMS segment.

The margins of the company have been abnormally high in the CRAMS segment. The same might be attributed to the unique research work the company has been doing in CNS segment. The rupee depreciation should also be highly rewarding for the company.

Another exciting thing about the company is the upcoming "addition of a new green field site at Vizag with an outlay of around Rs 100crs which in turn adds to the growth and profitability in the years to come." With all this innovation, patents, research and USFDA approvals, the company looks attractive at a market capitalization of Rs.528 Crores.

However, there are a few points which make me give a miss to this stock:

-

The amalgamation of Asian Clinic Trails in 2007 is an interesting one. I feel that the company overpaid (in form of equity shares worth more than 30 Crores at that time) for an acquisition of net assets worth 2.73 crores. The resulting promoter's equity raised from 54.5% to 61.5%, while also created additional reserves in the books.

-

As per the FY 2013 annual report, the company has a surplus bank balance and deposits of over 20 crores. I see it as a weak financial management to have a corresponding borrowings of ~100 crores.

-

The stock has been far too volatile along with huge volumes.