Today I went through the brilliant Killer Puzzle shared by Prof. Bakshi.

The company has an excellent set of financials, with the pre-tax returns of 64% on the net operating assets. The returns are supported by clean cash-flows and dividends.

The main questions were:

- How is the company able to earn extra-ordinary margins (of over 25%)?

- Are these margins maintainable?

- How should the company be valued?

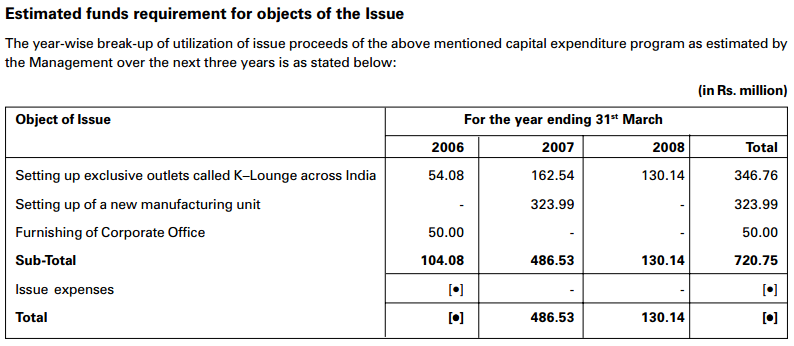

Since the company came with the IPO in 2006, I began with the red-herring prospectus to understand the reasons for IPO.

I also went through the articles on Spykar and Kuotons to learn from their failures. It was mostly the rapid pace at which they opened stores and took debt. Thus increasing the operational costs of rents and inventory.

Kewal Kiran seems to be doing okay on that front. Arvind's Flying Machine closely resembles the company's segment, but the raw-material cost is 50% in contrast to 40% in case of Kiran. Thus there must be some operating efficiencies too in the case of Kewal Kiran.

In an old discussion on a forum, one of the comments (from Prof. Neeraj Marathe) said:

Their business model is a lot different from others. What they do is SELL the entire inventory to the franchisee (shop owner). This reduces a lot of working capital, explaining the better balance sheet.

Secondly, whenever there are a lot of stores added (not their own), you will see a jump in sales. This is cause the franchisee has to set up shop with about Rs.20 lakh worth of clothes..(i talked with the shop owner near my place) whether the shop manages to sell the clothes to customer or not, KKCL books the sales. (nothing wrong in it..quite a good policy)

The discussion from IVY League summarises the business best:

“We must look at fashion and not garments as a business. Fashion is all about marketing, trends, understanding the consumers, social changes, and what’s going to sell. You need not necessarily produce what’s going to sell. You could outsource it. GAP does not produce a single garment in-house. Lacoste which is available all over the world employs only 53 employees. They don’t make or sell a single product.”

Overall, I love the company's balance-sheet and the business model. But I am unable to find a proper valuation for it. In next few days I will try to compare it with CERA, which looks cheaper.

I still have a few doubts and concerns:

- Why so high margins? (I visited one of their K-Lounge in city and didn't get a very good feel).

- The high number of stores closing recently.