Today I began with the "Theory of Common-Stock Investment" from the Security Analysis book. I always related Graham only with deep-value/distressed/liquidation investing, but in this chapter Graham discusses and compares about the growth/trend investing too.

The chapter defines [value] investments as the ones which have:

- a suitable and established dividend return,

- a stable and adequate earnings record, and

- a satisfactory backing of tangible assets.

In growth/trend investing:

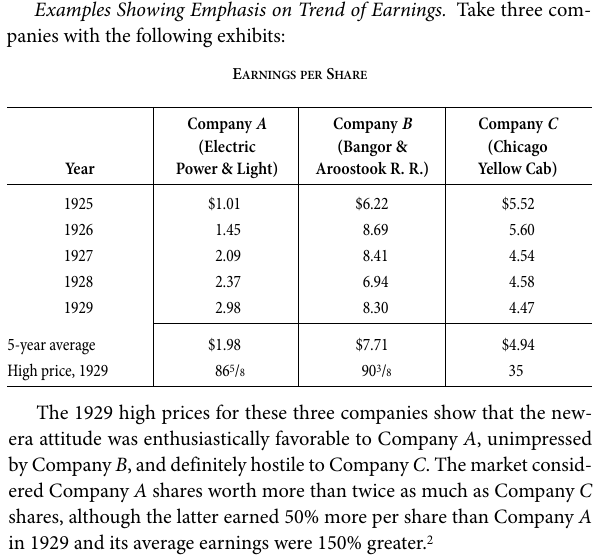

Two of the three elements above stated lost nearly all their significance, and the third, the earnings record, took on an entirely novel complexion. The new theory or principle may be summed up in the sentence: “The value of a common stock depends entirely upon what it will earn in the future.” From this dictum the following corollaries were drawn:

That the dividend rate should have slight bearing upon the value.

That since no relationship apparently existed between assets and earning power, the asset value was entirely devoid of importance.

That past earnings were significant only to the extent that they indicated what changes in the earnings were likely to take place in the future.

Graham even says that it was a "sound premise used to support an unsound conclusion." The prices rise "for the simple reason that common-stocks earned more than they paid out in dividends and thus the reinvested earnings added to their worth."

Thus the trend/growth theory is attractive as long as "common-stocks earned more than the bond-interest rate upon their cost. This would be true, typically, of a stock earning $10 and selling at 100." The moment we start paying 20-40 times earnings, the "earning power is no greater than the bond-inter- est rate, without the extra protection afforded by a prior claim." The analysis of the balance sheet and earnings is still stressed upon.

One company that looks close to the concepts of "investing" is Oriental Carbon & Chemicals.

-

The company provides a dividend yield of 5% (and more than 4% yield for each of the last 4 years dividends). Thus the company has "suitable and established" dividend return.

-

The 10 years average earnings have been 14.54 crores and 5 years average earnings have been stable at 25 crores 1 . On the market capitalization of 98 crores the earnings are adequate.

-

Market capitalization is almost half of the net-worth of 170 crores. Thus there is a satisfactory backing of tangible assets.

-

Due to paucity of time I was not able to make adjustments of "economic earnings" for each year. On the balance sheet too I only made the obvious adjustments. ↩