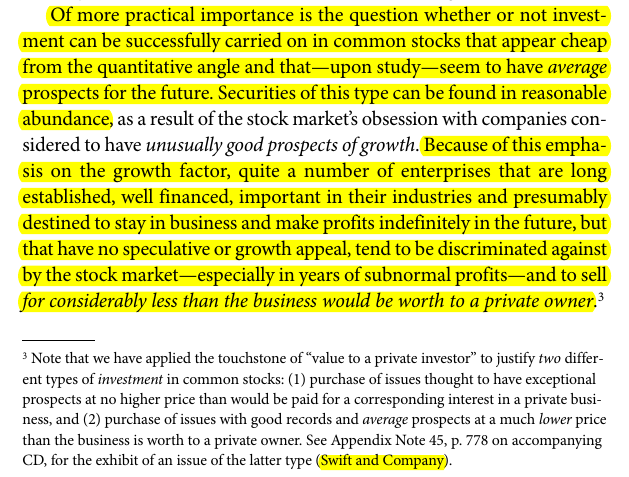

Today I continued with the "Theory of Common-Stock Investment" from the Security Analysis. The thing that striked me the most was this passage:

My aim for the day was to find one such company which is "long established, well financed, important in its industry and presumably destined to stay in business and make profits indefinitely in the future, but that have no speculative or growth appeal"

Tata Sponge seemed to fit well into that definition. The company has an average earnings of Rs.70 crores over last decade and the market capitalization is Rs.450 crores. The net-worth is 640 crores.

Off this net-worth of 640 crores, Rs.361 crores is in fixed deposits and investments. Thus funds used in operations are around 278 crores (with 161 crores of depreciated fixed assets) 1 .

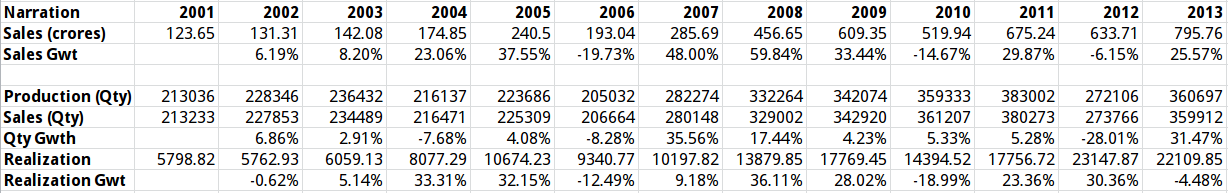

Over last few years, the operating margins of the company have reduced from 30% levels to current 13% levels. This has been mainly because of the high raw-material prices (58% of cost in 2008 vs 75% of cost in 2013).

From the above volume data it doesn't look that the company is going through a permanent bad phase. The down-swing looks purely cyclical, though it is hard to estimate how long it can continue.

Overall it does look like a company where there has been no recent growth, and the valuations have depressed for this reason.

Some concerns:

-

What kind of upside are we looking for in such cases (i.e. what is the good selling point)? (I would give the intrisic value of around 600 crores based on 3 kilns and the cash, though much will depend on how the company goes on to deploy this cash).

-

How long can it take to unlock the value (or rather how long can the depressed cycles continue)?

I guess the answers to the above too must be somewhere in this excellent book.

-

The excessive cash is presumably for the development of Radhikapur Coal Block. ↩