Another of the interesting and cyclical company that was long pending in the list was KCP Sugar.

I analysed the company on the same parameters as Tata Sponge.

The Company is engaged in the manufacture and marketing of wide range of products that can be broadly classified under three groups:

(1) Sugar (contributing over 90% of revenue)

(2) Bio-products

(3) Engineering unit for manufacture of solid liquid seperation equipments through its subsidering.

Market capitalization: 192.21 Crores

10 Years average earnings: 26 Crores

Net worth: 230 Crores

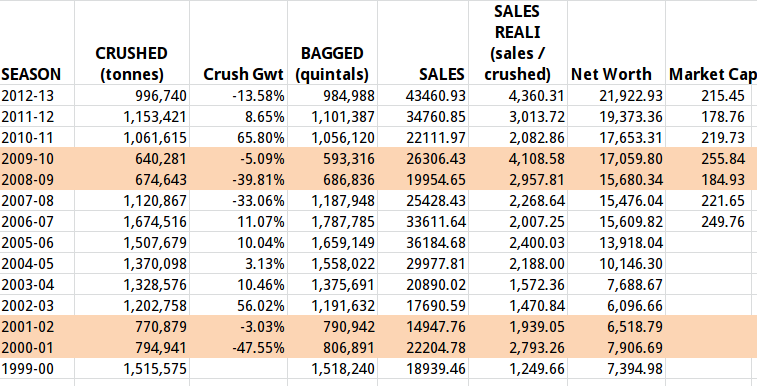

The company's profits started declining (from PBT of 96 crores in 2006 to 7 crores in 2008) when the "sugar cycle reversed due to high supply and low demand" in 2008.

After a long time the market capitalization of the company has fallen below the net-worth. At the same time the company has reduced the debt by half (from sub 100 crores to sub 50 crores).

Another interesting development in the industry is deregulation of sugar prices and supply.

Together these provide an exciting opportunity in the stock. To derive some intrinsic valuation, I followed the easy technique of compounding the 10 year average earnings by risk free rate = 26 / (8.75%) = 297 Crores.

In the upcoming days I would try to improve upon the concepts of intrinsic value as I further read the book.